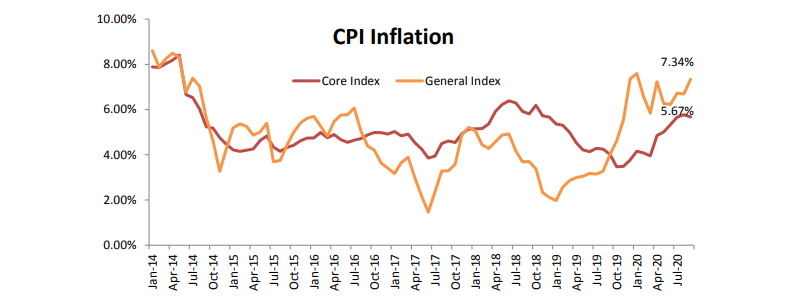

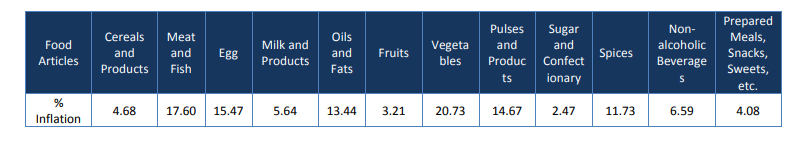

The CPI based inflation surged further and was reported at 7.34% for the month of Sep’20 as compared to 6.69% for the preceding month and 3.99% during the year ago period. The inflation numbers have remained sticky above the 6% level and breached the 7% mark for the third time in CY2020. The elevated levels of food inflation during the year have been the major factor contributing to higher headline numbers. The inflationary pressures were marginally higher in rural centres as compared to urban centres. The CPI Rural inflation was reported at 7.43% as compared to 7.26% level for CPI Urban.

The continued firmness in food prices has been the major contributor to the upward surge in headline numbers. The

pandemic related lockdown and the resultant demand destruction has mostly kept the inflation rates for other

components under check. The same factor on the other hand led to high demand for essentials. The logistical constraints impacting the smooth supply too created upward pressures in prices of food articles. In this context, the RBI noted in its latest policy statement that, “While inflation has been above the tolerance band for several months, the MPC judges that the underlying factors are essentially supply shocks which should dissipate over the ensuing months as the economy unlocks, supply chains are restored, and activity normalises.” The extended monsoon season in parts of the country has had an effect on the price levels of perishables. The components within food basket to report heightened inflationary pressures were Meat and Fish, Egg, Vegetables and Pulses.

Fuel Prices: Even as the international crude prices have remained range bound, the hike in duties domestically has

maintained an upward pressure on domestic prices. The appreciation in INR vis-à-vis USD over the last six months too has been supportive in keeping the fuel-based inflation at bay. The fuel-based inflation eased marginally to 2.87% for the month of Sep as compared to 3.18% in the preceding month. The lockdowns have gradually being relaxed but the precautionary measures in place are expected to keep the crude demand outlook subdued in the near future.

Core Inflation: As against the uptick seen in headline numbers, core inflation eased marginally in the month of Sep’20. The core inflation came in at 5.67% for the month of Sep as compared to 5.77% in the preceding month. The Pan, Tobacco and Intoxicants continued to report double digit inflation, albeit at a slower pace. The Miscellaneous component, the indicator of price pressures in services industry, too has reported easing from 6.99% in the month of Aug to 6.89% in the month of Sep. Within Miscellaneous component, heightened price pressures were seen in Transport & Communication and Personal care and Effects.

Outlook: The inflation numbers continue to remain outside the RBI’s comfort zone of +/-2% of 4% and it may continue to be elevated over the near term. Though, this may not have a material bearing in terms of RBI deciding to change its policy stance, as was seen in the latest policy decision of the RBI, the rate cuts may get pushed further till the time inflation sustainably falls within its target range but the policy stance would continue to be growth supportive. The economic growth was showing signs of weakness even before the pandemic and the situation further worsened in the wake of COVID. In the words of the RBI, “The MPC is of the view that revival of the economy from an unprecedented COVID-19 pandemic assumes the highest priority in the conduct of monetary policy.”

The outlook on the inflation front remains largely sanguine over the medium term, as the pressures are mostly emanating from the food component. A satisfactory monsoon season and the resultant positive impact on the kharif harvest may lead to gradual easing of prices of food articles. Again, as noted by RBI, the gradual easing of cost-push pressures owing to progressive easing of lockdowns may lead to easing of headline inflation numbers.