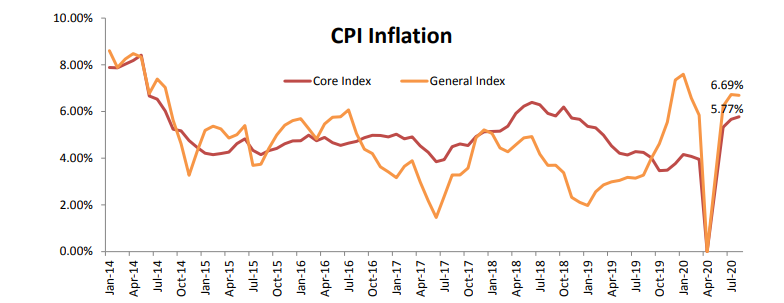

The CPI based inflation was reported at 6.69% for the month of Aug’20 as compared to 6.73% for the preceding month and 3.28% during the year ago period. The inflation numbers have remained sticky at around 6% levels for the year 2020. The elevated levels of food inflation during the year been the major factor contributing to higher headline numbers. The inflationary pressures were witnessed across both, rural and urban centres. The CPI Rural inflation was reported at 6.66% as compared to 6.80% level for CPI Urban. The inflation numbers have been running above the RBI’s target range, 4% +/-2%, since the start of the current calendar year.

One of the mysteries of the recent surge in inflation numbers is the absence of demand. Even as the nation has

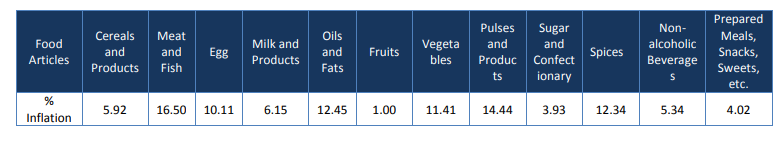

remained in a lockdown owing to the pandemic situation, inflation numbers have remained at sticky levels. The supply restrictions and aggressive buying of essential items are mostly cited as the reasons behind the uptick in inflation numbers. This phenomenon is fairly reflected in the food articles becoming dearer over the course of the lockdown. The heavy rainfall and flood like conditions in several parts of the country too has impacted the supply of perishables and visible from the sharp rise in prices of vegetables. The inflation rate for vegetables was reported at 11.41% for the month of Aug. Similar or higher inflationary pressures were also witnessed in the other commodities from the food basket such as Meat & Fish, Oils & Fats, Pulses and Spices.

The receding impact of inclement weather and the easing of logistical hurdles may lead to easing of food articles price going ahead is the base case expectation at the current juncture. The base effect too may turn favourable, as the food inflation had started inching up from Sep’19.

Fuel Prices: Even as the international crude prices have remained range bound, the hike in duties domestically has

maintained an upward pressure on domestic prices. The fuel-based inflation hardened further to 3.10% for the month of Aug as compared to 2.66% in the preceding month. The second-round effects of rising fuel inflation may create upside risks for headline inflation numbers.

Core Inflation: The core inflation, ex food and fuel, too has reported an uptick over the last three months. It is

considered a better representative of demand pressures owing to relatively elastic consumption patterns of underlying components as compared to food and fuel. The core inflation came in at 5.77% for the month of Aug as compared to 5.66% in the preceding month. The Pan, Tobacco and Intoxicants has witnessed a sharp up move, the inflation getting reported at more than 11.22% for the month of Aug. The Miscellaneous component, the indicator of price pressures in services industry, too has reported an upward move in inflation. The inflation numbers for the said component were reported at 6.99% for the month of Aug. Within Miscellaneous component, heightened price pressures were seen in Transport & Communication and Personal care and Effects

Outlook: The inflation numbers remaining outside the targeted range of RBI, may have a bearing on the monetary

policy decisions. Given the severe slowdown in economic growth, the policy stance may continue to be accommodative for an extended period of time but the immediate fallout may be an extended pause in rate cuts. The headline CPI falling sustainably within the RBI’s target range may be the precursor to RBI effecting another rate cut.

At the current juncture the base expectations are tilted in favour of a gradually easing headline inflation over the near term, as the normal monsoon season may yield a bumper kharif crop. The gradual rise in core inflation is another important monitorable, but any sharp gains in this segment are expected to capped owing to low demand scenario.