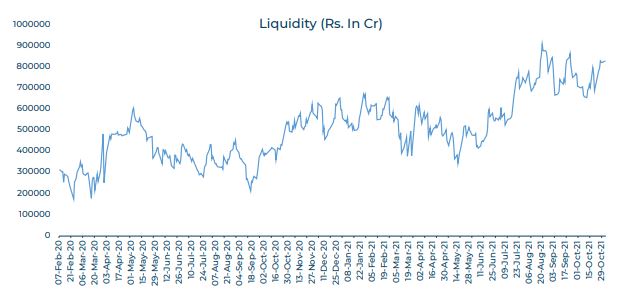

The fixed income market faces a number of challenges as it transforms itself from the pandemic-affected period, the high liquidity situation, to the post-pandemic normalization. The challenges pertain to the gradual normalization of liquidity and rising interest rates. The RBI had initiated the liquidity normalisation process way back in January this year. The hike in the cash reserve ratio by 1 % effective from March and May resulted in the first such normalization. The hike in CRR meant a transfer of free cash from the banks to the RBI. To support the smooth sailing of the issue of government securities, RBI has been putting some liquidity into the markets through GSAPs during the first half of the financial year. There were two tranches of GSAPs in the first half of the year.

RBI in the last policy announcement put an end to this. That is, for the second half of the year, the central bank has put a halt to the GSAPs. It means that there will no longer be any liquidity support, which used to bring some consolation to the markets. The RBI has now introduced a regular program of withdrawal of liquidity through the variable rate

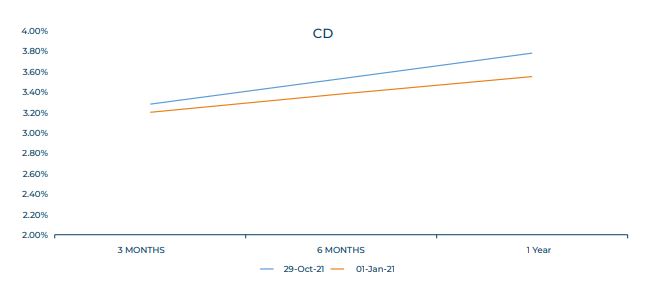

reverse repos. The recurrent repos would reduce the available liquidity, thereby, helping to keep the short- term rate at desired levels, that is, higher than the reverse repo and higher than the short-term treasury bills rates. Therefore, the process of normalization is already started, and it is on, and this may go on for another six months.

The fresh issues of government securities both by the central government and the state governments will be majorly at the long end of the curve, that is, 10 years plus maturity. The issue of fresh securities will, therefore, impact the yields at the long end of the curve. There is no visible buoyancy in the GST collections as yet due to obvious reasons. Therefore, the likelihood of further borrowings coming up at the fag end of the year cannot be ruled out, unless something dramatic happens in the disinvestmentsspace to provide the government with the requisite cash support. The current 10 year which is at 6.35 % may move up as fresh supply hits the markets.

The level of inflation has moderated in the last two months but there is a slight uptick in retail inflation in the latest CPI number. While the prices of fruits and vegetables may be under control to a large extent, the fuel prices are a cause of concern. The Brent which is a shade above the US$ 80 level has stayed above that mark for a long time now, and the fuel prices moving up from here to higher levels with a relatively cheaper local currency could be a source of more sustained high prices. While liquidity rationalization measures are on, and the RBI may be more focused on that, any move closer to the policy target levels in inflation or a breach of the same could invite an early action from RBI.

There has been a lot of discussion on the inclusion of gilts in overseas bond indexes. If it happens it will be a good support for the bond markets as it could attract funds from abroad which track such indexes. But one of the pre-conditions which overseas entities were insisting on is full capital account convertibility of the Rupee. Though we have enough forex reserves to pay for one year of import bills, there is a lot to be done before we could move towards full convertibility. It may also be stated here that under the existing limits which are already available for external investors, barely 40 % of the room has been utilized so far.

While the inclusion will be a very good measure, the positive impact of the same could be limited in the immediate term. The yields at the long end of the curve will continue to be under pressure, and therefore, the focus of investments should be at the short end of the curve, and any meaningful accrual strategies, may be considered for deploying funds.