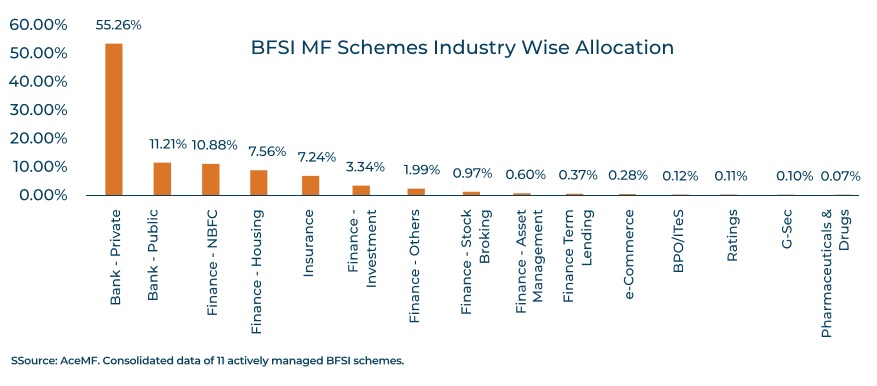

The Banking & Financial Services sector (BFSI), over the years, has emerged as one of the most diverse plays on the India growth story. While the importance of a stable banking industry to support the economic growth cannot be stressed enough, the opportunities available across the financial services segment today make this sector an even more compelling investment avenue. The investment benefits of a large part of the populace moving from unbanked to banked, are now well complimented by financialization of savings as well as changing spending behaviour. The sector, which was largely represented by banking and NBFC plays, has now evolved to include insurance companies, asset management companies, wealth managers, e-commerce companies, rating agencies and may very soon see listing of even stock exchanges.

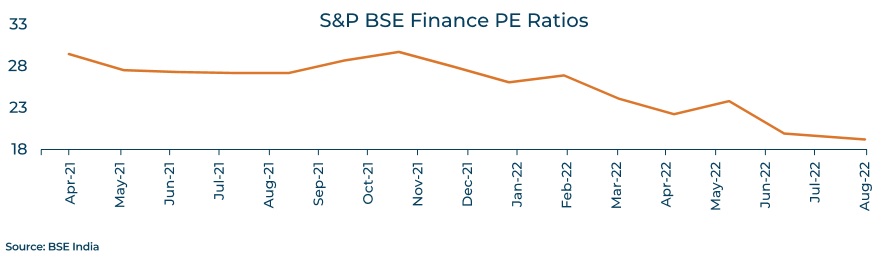

While the diversified equity mutual schemes do have allocation to BSFI sector, in many cases BFSI being the top sectoral weight, the varied number of sub-industries and large number of listed plays warrant investments to dedicated BFSI sectoral schemes. The diversified mutual fund schemes may not have exposure to all the sub-industries and may also restrict the allocation to the top player from the selected segment. Given that the BFSI is not a saturated sector and the size of the business opportunity pie has huge potential to increase, there may be more than one winner in terms of gaining market share. Along with the opportunity of the sector the other most important factor to consider are the valuations. The valuations for BFSI sector remain comfortable and have become incrementally attractive over the last one year.