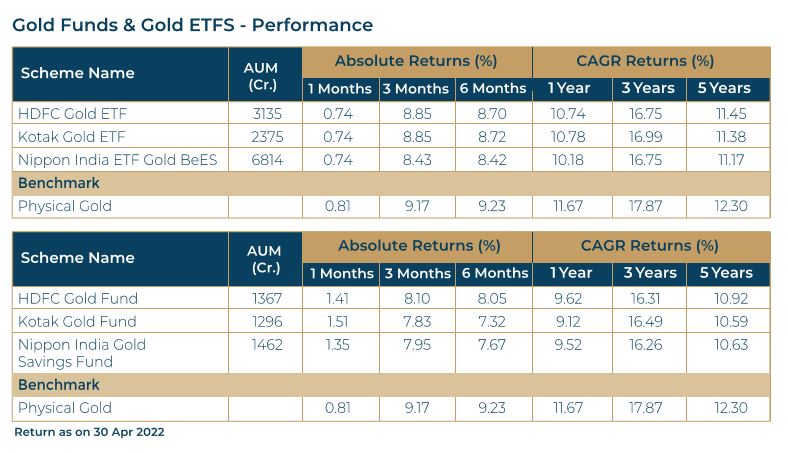

Gold price in international market has slumped to US$ 1815. While the surging inflation in the major economies of the world makes it an appropriate choice for some amount of value preservation, the strength in the US Dollar and the rising US rates are putting pressure on gold price. There is a clear positioning from the Fed that the rate hikes will continue till inflation is tamed. And only after reliable data to the contrary is available should there be any change in the interest rate policy. The rising rates will make it quite attractive for investors to stay in the currency to earn the higher currency yield. This has also led to a strengthening US currency. Gold being quoted in US Dollars; the price is bound to come down. Retail demand in India remained at the same level whereas the demand in China fell after the imposition of covid restrictions. The inflows into gold ETFs was 43 tonnes, close to US$ 3.00 billion in the month of April. This amount is lower compared to the month before but still an indicator of a turn in the tide. The gross ETF holdings is at 3869 tonnes or US$ 238 billion, as against the 3922 tonnes holdings in November 2020. The support levels for gold are at 1760 and 1730 levels, and the upside may be capped at 1930