One of the means by which a higher yield can be captured for the debt investment portfolio is to invest into mutual fund schemes that have State Development Loans as the underlying asset. These investments have multiple advantages.

(a) The SDL portfolios have yields in the range of 7% to 7.7% depending upon the state government whose paper is picked up, and the maturities are in the range of 5 years to 10 years. The yields having moved up in the last six months after the RBI started the liquidity normalization process and the rate hikes to quell the tide of inflation.

(b) Compared to the issue of central government dated securities, the issue of dated state government securities is much smaller, and therefore, the issues at the primary auction will be far and few. This would also keep the demand for these papers upbeat. Moreover, there is always a mark-up to the central government securities in yields and therefore, a corresponding discount in price, for SDL securities.

(c)The SDL portfolios carry a relatively higher yield compared to any other comparable portfolio in the debt space with sovereign rating. In terms of quality, it is of higher quality as the underlying being state development loans. There are no worries associated with credit risk as a such, though state governments based on their financial position are likely to be classified into different categories.

(d) There is yet another factor which makes the SDLs more attractive. The bond funds, for three years or five years, could avail of the benefits of inflation indexing. The indexation benefit will make the tax liability on the gains from the investment very negligible. This is a major benefit that will accrue from the investments in SDL funds. There are coupon flows on a half yearly basis which gets re-invested at the market rate.

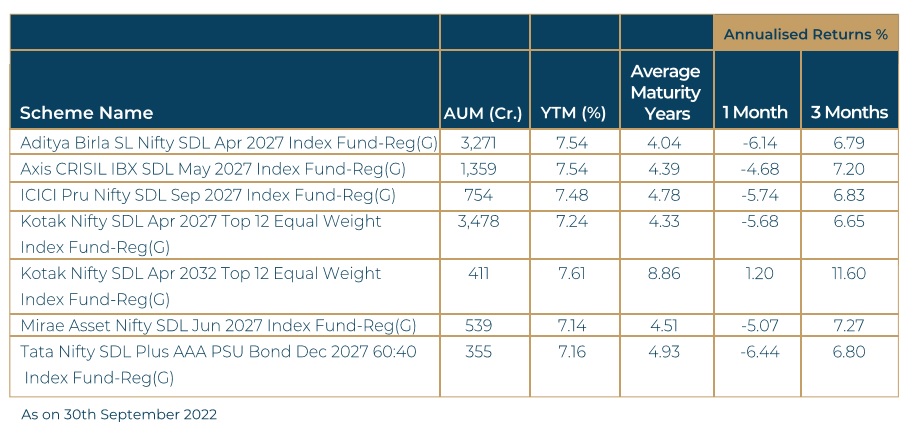

Some of the prominent SDL funds are given below: