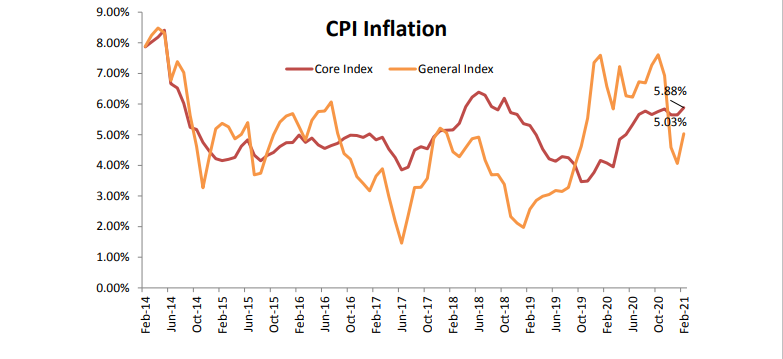

The CPI based inflation, after easing for three consecutive months, rose on the back of upward move in food prices;

headline CPI inflation was reported at 5.03% for the month of Feb’21 as compared to 4.06% for the preceding month

and 6.58 during the year ago period. Over the recent past it has been the first instance where in the headline inflation

numbers and the core inflation both have risen in tandem. The broad-based rise in inflation numbers across the

components is indicative of an improving demand scenario and underlying cost pressures. The WPI inflation for the

month of Feb’21 came in at 4.17%, a 27 month high, as compared to 2.26% in the preceding month.

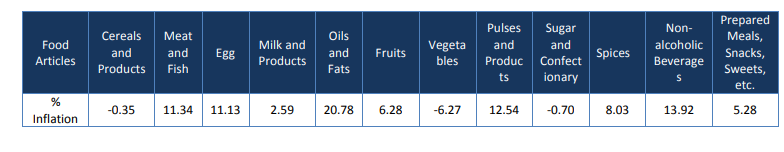

As has been seen for the headline numbers, the Consumer Food Price (CFP) inflation too rose hardened for the first time in three months. The CFP inflation was reported at 3.87% for the month of Feb’21 as compared to 1.96% for the preceding month. A slower fall in Vegetables prices and continued firmness in Meat & Fish, Oil & Fats and Pulses led to uptick in food inflation. The firmness in prices was not restricted to food prices, other components such as Pan, Tobacco & Intoxicants, Clothing & Footwear and Miscellaneous too moved up. The risk of inflation has moved to a higher side as there have been signs of cost push leading to hike in the output charges by the manufacturers. The inflation rates have remained mostly stable till now owing to producers aiming to protect demand.

Fuel Prices: Brent has shot up, through the US$ 70 per barrel, and it looks set to rise more. The general direction of rise in prices has been expected widely by analysts across the continents due to several factors. The most prominent factor is the output restrictions by OPEC + and more conspicuously by Saudi Arabia. These output restrictions were further reaffirmed by Saudi and OPEC+ once again recently. The fall in the US inventories of crude is also a factor which has caused some nervousness at the marketplace. Yet another factor that has been supporting higher oil prices is the rebound in economic activity that is witnessed across economies mainly on account of lower interest rates and liquidity expansion. The rising oil prices is in itself a cause for inflation in some of the major importers of oil and this may have some impact on the trajectory of the overall price level, and therefore, central bank policies on base rates.

Core Inflation: The core inflation has been hardening since the last two months, which was largely expected as it is more representative of economic growth due to the demand elasticity of its sub-components. The core inflation rose to 5.88% for the month of Feb, as compared to 5.65% in the preceding month. As the pandemic led lockdowns were gradually relaxed and demand improved, its effects are visible in the core inflation. The Pan, Tobacco and Intoxicants continued to report double digit inflation, for the ninth consecutive month. The Miscellaneous component, the indicator of price pressures in services industry, reported inflation of 6.82% in the month of Feb as compared to 6.49% in the preceding month. Within Miscellaneous component the pace of rise in inflation was the quickest in Transport & Communication and Personal Care & Effects, at 11.36% and 8.65% respectively.

Outlook: The fall in food prices was the predominant factor that led to fall in headline inflation numbers within the RBI’s target range. The reduction in the contraction level of key food basket component triggered an uptick in CFP inflation and consequently taking the CPI inflation number higher with it. The Core inflation too continued its movement higher, thereby creating further tailwinds for the inflation trajectory. As was discussed in the previous issue, the expected pickup in growth will not only improve demand but also the pricing power of suppliers. The effects of the same were witnessed in the WPI numbers, as it touched a 27- month high. The manufacturers’ survey captured through the PMI report too indicates that the input cost pressures continue to remain on the upside. As the confidence of demand sustenance improves, there may be some pass-on effect that gets reflected in CPI numbers.

The current set of inflation numbers may not impact the policy decisions, specifically on the policy rates front

immediately but it may make the endeavour of the central bank to control the upward momentum seen in market yields more difficult. As the inflation and inflationary expectations start inching upwards, the market yields may not necessarily reflect the accommodative monetary policy stance of the RBI.